A new report has raised concerns about the UK pensions sector’s continued failure to address its role in financing the climate and nature crises, despite the growing risks these present to both the planet and British savers.

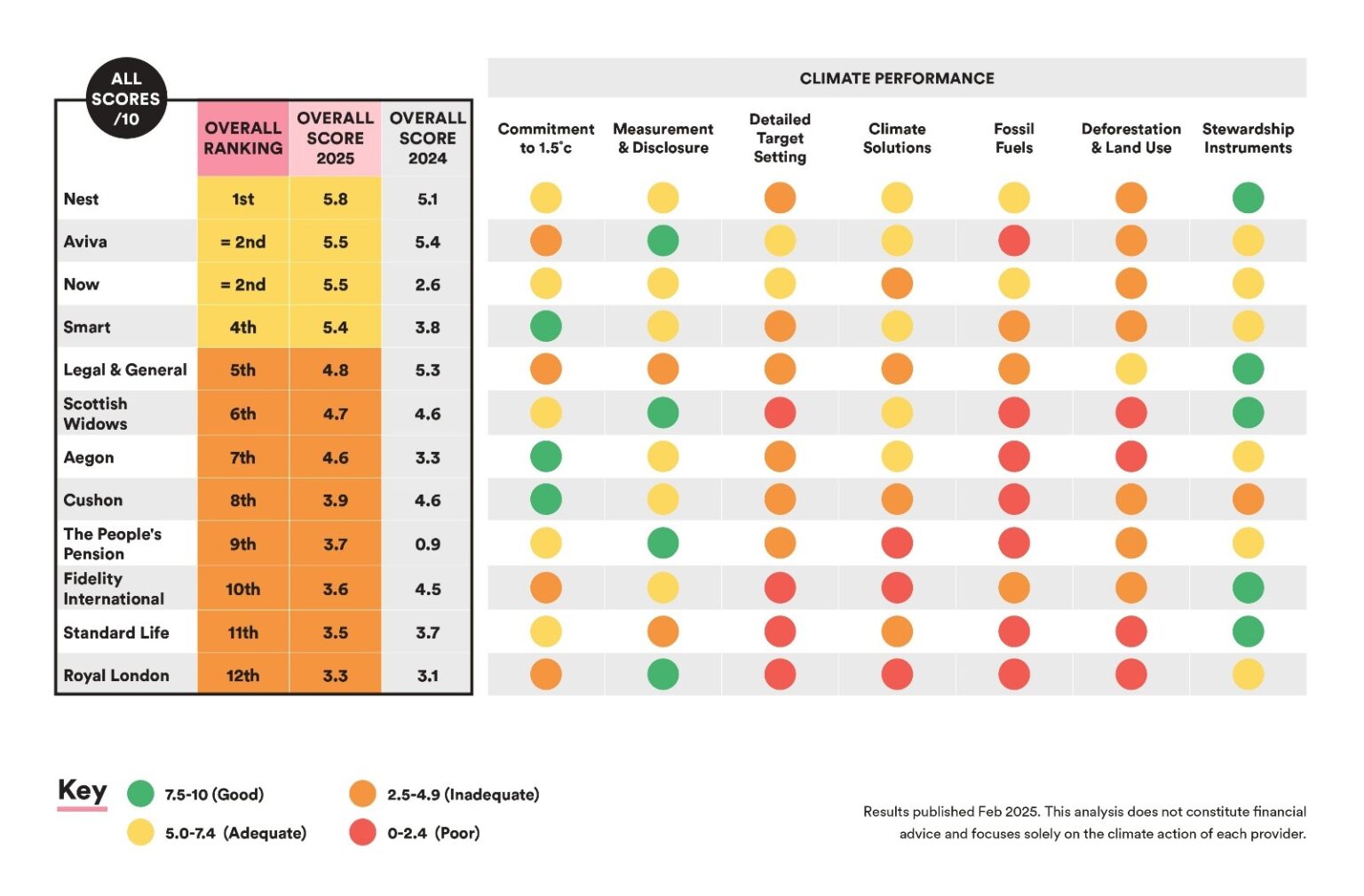

The Make My Money Matter campaign, co-founded by filmmaker Richard Curtis, has released its annual Climate Action Report, assessing the climate-related performance of the UK’s 12 largest workplace pension providers, which manage 44 million pension pots. The updated findings show that while some progress has been made, the overall response from the sector remains “inadequate,” with the average score for the companies standing at just 4.5 out of 10.

The report, produced in partnership with sustainability research provider Profundo, highlights a concerning stagnation in scores from major players like Standard Life and Royal London, with profits continuing to grow without corresponding improvements in climate action. Among the most critical issues are the ongoing investments in fossil fuels, with seven of the 12 providers continuing to invest in ExxonMobil – a company set to increase its oil and gas output by 18% over the next five years, despite global calls for a transition away from fossil fuels.

The pension sector’s investment in fossil fuels remains a significant challenge, with the sector exposed to a £300 billion risk linked to deforestation and a staggering £3,000 per pension holder in oil and gas investments. Shareholder actions are also under scrutiny, as companies such as Aviva and Legal & General have been criticised for their passive voting behaviour at AGMs of oil giants like Shell and BP.

Despite this, some providers are making strides. Nest Pensions, now ranked first for climate action, has improved its environmental policies and outpaced competitors in reducing its environmental impact. Smart Pension and Now: Pensions have also moved up in the rankings, showing an encouraging trend towards more proactive climate action.

The findings also reveal that no pension providers scored a “poor” rating this year, with 4 out of the 12 now scoring 5 or above (labelled as “adequate”), up from just 3 last year. However, the report highlights the pressing need for improvement, particularly in reducing exposure to fossil fuels and tackling deforestation, two areas where the sector continues to fall short.

The most positive takeaway from the report is the establishment of a new benchmark for “ideal” pension fund performance. If all providers achieved the highest score across each theme, the sector could achieve an overall score of 7.6/10 – setting a clear standard for what is possible if all funds increase their climate efforts.

Tony Burdon, CEO of Make My Money Matter, commented on the findings: “The urgency of the climate and nature emergency is only growing, yet the UK pensions sector is still failing to take the necessary action to protect both our planet and our savers’ futures. It’s time for pension providers to step up, particularly those like Standard Life and Royal London who continue to fall behind.”

The campaign group is urging savers and employers to hold their pension providers accountable for their climate performance, and where necessary, seek out greener options.

Jan Willem van Gelder, Director of Profundo, emphasised the need for UK pension funds to follow the lead of more responsible European funds: “UK pension providers are lagging behind their European counterparts when it comes to addressing the climate crisis. The sector must divest from companies that are actively exacerbating the climate emergency and follow the path set by their European peers.”