1. Framing the Conversation: Why This Review Matters

When a broker claims 0 % funding fees, 13 millisecond fills, and zero-spread trading, curiosity naturally follows. Rather than hype, this Fletrade.com review sets out to verify how those promises translate into a day-to-day trading environment.

We’ll examine Fletrade’s technology stack, trading conditions, account tiers, asset coverage, and many more, steering clear of recommendations and focusing on what you can realistically expect.

2. Snapshot Stats You’ll See on the Homepage

- 0 % funding fees & spreads from 0.0 pips

- 1:1000 maximum leverage for those who need extra gearing

- Micro-lot capability (0.01) for precision sizing

- 2 100+ instruments across seven asset groups

- < 13 ms average execution backed by deep liquidity

- 15-year operational track record and 250 K+ users across 67 countries

These headline numbers are eye-catching, yet their real value lies in the infrastructure underneath, latency-optimized servers, multi-LP liquidity aggregation, and true no-dealing-desk order routing.

3. Trading Infrastructure: Speed as a Philosophy

Fletrade’s execution engine is built around three pillars:

- Ultra-low latency networking that co-locates servers near major liquidity hubs.

- Aggregated order books from multiple liquidity providers (LPs), narrowing the bid/ask and limiting slippage.

- Dynamic smart-routing that scans each venue in milliseconds, aiming to fill at the best available price without dealer intervention.

During calm markets, that all feels instantaneous. More impressive is how the setup holds during high-impact news releases, according to in-house data, most orders still clear the pipeline in under 13 milliseconds, which helps chartists and algo traders preserve strategy integrity.

4. Asset Universe: Beyond the Usual Majors

- Forex – 70 pairs from EUR/USD to exotic ZAR/JPY.

- Cryptocurrencies – BTC, ETH, and a rotating list of alt-pairs, all with 24/7 pricing.

- Shares – Hundreds of equities spanning tech, pharma, and green energy.

- Metals – Spot gold, silver, palladium, and platinum.

- Energy – Brent, WTI, and natural gas CFDs for macro-themed plays.

- Indices – Benchmarks from Wall Street to the Hang Seng.

Coverage breadth means portfolio hedging, pairing, say, Nasdaq longs with crude shorts, is doable without leaving the ecosystem.

5. Superior Conditions, Zero Commissions

Unlike traditional ECN models that offset razor-thin spreads with ticket fees, Fletrade pairs competitive spreads with no commission at the PRO+ and ELITE tiers, a standout point highlighted throughout this Fletrade.com review.

Lower-tier accounts do face slightly wider spreads (starting at 1.2 pips on BASIC), but that structure is transparent and clearly presented. Add Fletrade’s 0% funding fees, and traders planning to hold overnight positions in crypto, metals, or indices may find carrying costs refreshingly lean, aligning well with the overall advantages covered in this Fletrade.com review.

6. Account Architecture, Four Ladders, One Theme: Choice

| Tier | Spreads | Extras |

| BASIC | FX from 1.2 pips | Micro lots, core analytics |

| PRO | FX from 0.6 pips | Dedicated account advisor |

| PRO+ | Zero spreads | $3.5/lot side commission cap |

| ELITE | Zero spreads | 21 % commission rebates, priority routing |

Upgrading is optional, not coerced; Fletrade’s portal lets you swap tiers once funding thresholds are met, so you can test drive incremental perks: tighter spreads, bespoke coaching sessions, or priority support, before committing larger capital.

7. Platform Walk-Through: Desktop Precision, Mobile Freedom

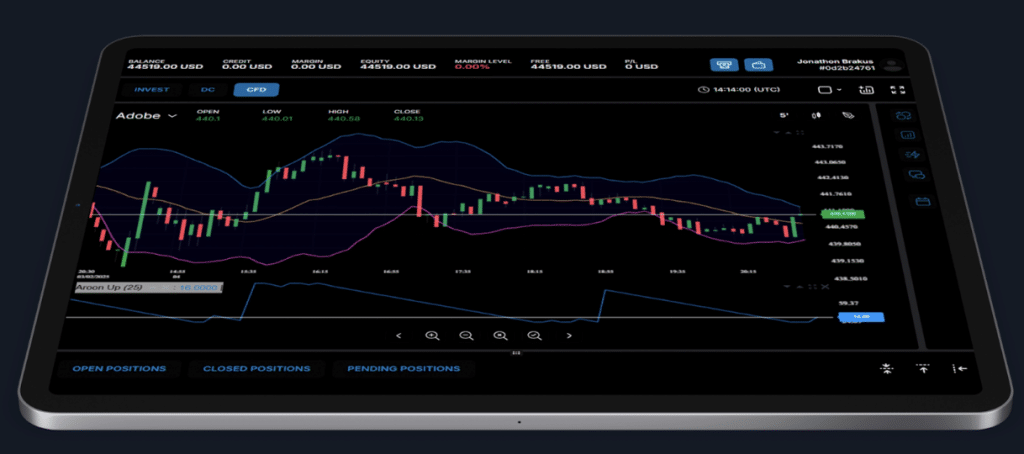

7.1 Web Terminal

The browser-based terminal offers 60+ built-in indicators, six chart types, and eight timeframes. Window detaching is handy for multi-monitor setups, while a dark/light theme toggle adapts to ambient lighting. Widgets, depth of market, economic calendar, sentiment dashboards, dock neatly without clutter.

7.2 Mobile App

Available on iOS and Android, the mobile suite supports one-tap order placement, biometric sign-ins, and in-app funding/withdrawals. Even on 4G networks, execution speed remains snappy, a testament to Fletrade’s edge caching and lightweight data packets. Push alerts for price levels, news, and margin usage keep positions front-of-mind when you’re away from the desk.

8. Funding and Settlement: Crypto-Native Meets Legacy Finance

| Method | Currency | Min Deposit | Notes |

| Binance, Coinbase, MoonPay | Crypto | $250 | Near-instant on-chain confirmation |

| Visa/Mastercard/Maestro | USD/EUR/GBP | $250 | 3-D Secure enabled |

| Bitcoin/Tether/Ethereum withdrawals | Crypto | $50 eq. | Processed within 1 hour (typical) |

Traditional bank wires exist, but plastic or crypto tends to clear faster. No funding fees sweeten the first-time deposit experience, while automated KYC keeps compliance friction low.

9. Security & Regulation: Ironclad by Design

This Fletrade.com review highlights how the platform’s security setup goes beyond basics:

- 256-bit SSL encryption across web and mobile.

- Two-factor authentication (2FA) via authenticator apps or SMS.

- GDPR compliance is overseen by an in-house Data Protection Officer, plus external audits.

- Regular penetration testing and incident-response drills.

- Segregated client funds with top-tier banks.

Fletrade lists a CNMV registration ID for EU transparency, while its CySEC recognition adds an extra layer of cross-border oversight.

10. Awards Wall: Third-Party Validation

- Best Social Trading Platform 2023 – Social Media Today

- Most Transparent Broker 2023 – Transparency International

- Best Mobile Trading Platform 2022 – Mobile App Awards

- Fastest Order Execution 2021 – Financial Times

Awards don’t guarantee future performance, but they hint at consistency across tooling, transparency, and execution metrics, attributes mirrored in this Fletrade.com review.

11. Numbers at a Glance: The Scale Factor

- 372 million+ orders executed since inception

- > 2 500 orders per second peak throughput

- $50 million of company capital

- 67 countries served

- 15 successful years navigating every market cycle from pre-crisis 2008 to post-pandemic 2025

Such scale underpins liquidity relationships, technology reinvestment, and user-growth momentum that’s hard to fake.

12. Vision & Values: Democratizing Market Access

Fletrade’s stated mission is “trading for everyone.” Practically, that shows up as:

- Micro-lot tickets that let new traders risk pennies rather than dollars.

- Educational webinars covering everything from candlestick basics to AI-driven sentiment analysis.

- Ongoing R&D into automation, visual analytics, and social copy-trading modules that simplify strategy discovery.

- Ethical framework advocating transparent pricing, non-conflicted execution, and strict data privacy.

These values echo across marketing copy, platform UX, and policy documents, building a cohesive brand narrative of inclusivity and innovation.

13. The Day-to-Day Experience: Putting the Pieces Together

As outlined in this Fletrade.com review, a typical trading session might look like this:

- Login & Biometric Check – Face ID unlocks the mobile app.

- Economic Scan – An embedded calendar shows a Fed speech in two hours; you set price alerts on EUR/USD.

- One-Click Ticket – News breaks, spreads remain razor-thin, the trade hits at the quoted price with no visible requote.

- Risk Tweak – You drag-and-drop trailing stops directly on the chart.

- P&L Snapshot – Real-time profit flashes in both base currency and percentage terms.

- Partial Exit – Close half the position; the remainder runs overnight at 0 % funding cost.

Throughout, latency feels invisible. The interface behaves the same whether you’re on desktop fiber, home Wi-Fi, or 5G.

14. Community Echoes: What Traders Talk About

Scrolling Fletrade’s forum reveals posts ranging from algorithmic-coding threads to screenshot celebrations of tight gold spreads during the London open. Common praise centers on:

- Order speed stability during macro surprises

- Zero-spread psychology that aids scalpers

- Responsive chat agents even at 3 a.m. GMT+8

While experiences vary by strategy and region, sentiment generally aligns with the performance metrics outlined earlier.

15. Future Roadmap: Innovation Pipeline

Peek into the public product backlog and you’ll find:

- AI-assisted strategy builder leveraging pattern recognition to suggest entry/exit logic.

- Layer-2 blockchain settlements aimed at sub-second crypto withdrawals.

- Carbon-neutral hosting initiative targeting full green energy by 2027.

Each initiative reflects the brand’s research-heavy culture and long-term view of brokerage as a technology service, not merely a trading venue.

16. Closing Thoughts: A Balanced Look Without Hype

As this Fletrade.com review has explored, the broker’s appeal stems from a fusion of zero-spread economics, near-instant execution, and broad multi-asset coverage. Traders looking for deep liquidity and crypto-to-fiat funding flexibility may find those features align with short-term or positional strategies alike.

Equally, the tiered accounts, educational library, and ironclad security architecture aim to accommodate novices without alienating high-frequency veterans.

Every broker relationship ultimately rests on personal risk appetite, strategy fit, and regional regulation, but Fletrade’s blend of speed, transparency, and scale positions it as a noteworthy contender in the modern brokerage arena, one that has spent 15 years iterating toward ever-cleaner execution and cost structures.